Future Energy Source Company Limited (FESCO)

Unaudited financials for the nine months ended December 31, 2024:

Future Energy Source Company Limited (FESCO), for the nine months ending December 31, 2024, reported an 8% increase in Revenue totaling $23.04 billion compared to $21.26 billion in the corresponding period last year. Revenue for the third quarter had a 2% decrease to close at $7.33 billion compared to $7.50 billion for the comparable quarter of 2023.

The Cost Of Goods Sold amounted to $21.75 billion (2023: 20.25 billion), an increase of 7% year over year. Consequently, gross Profit increased by 28% to $1.29 billion compared to $1.01 billion for the nine months ending December 31, 2023. The company reported a gross profit of $422.22 million for the third quarter versus $384.72 million reported for the similar quarter of 2023.

Other income increased by 8% to close at $3.10 million (2023: $2.88 million). Impairment losses on financial assets increased by 0% from $0 in 2023 to $1.97 million in the period under review.

Operating expense year to date reflected a 29% increase to $747.58 million compared to $579.09 million reported twelve months earlier.

Operating profit for the nine months ending December 31, 2024, amounted to $543.16 million, a 27% decrease relative to $429.34 million reported in 2023. Operating profit for the third quarter amounted to 152.91 million (2023: $151.30 million). Finance costs rose 33% to $136.69 million, versus $102.58 million reported for the corresponding period in 2023.

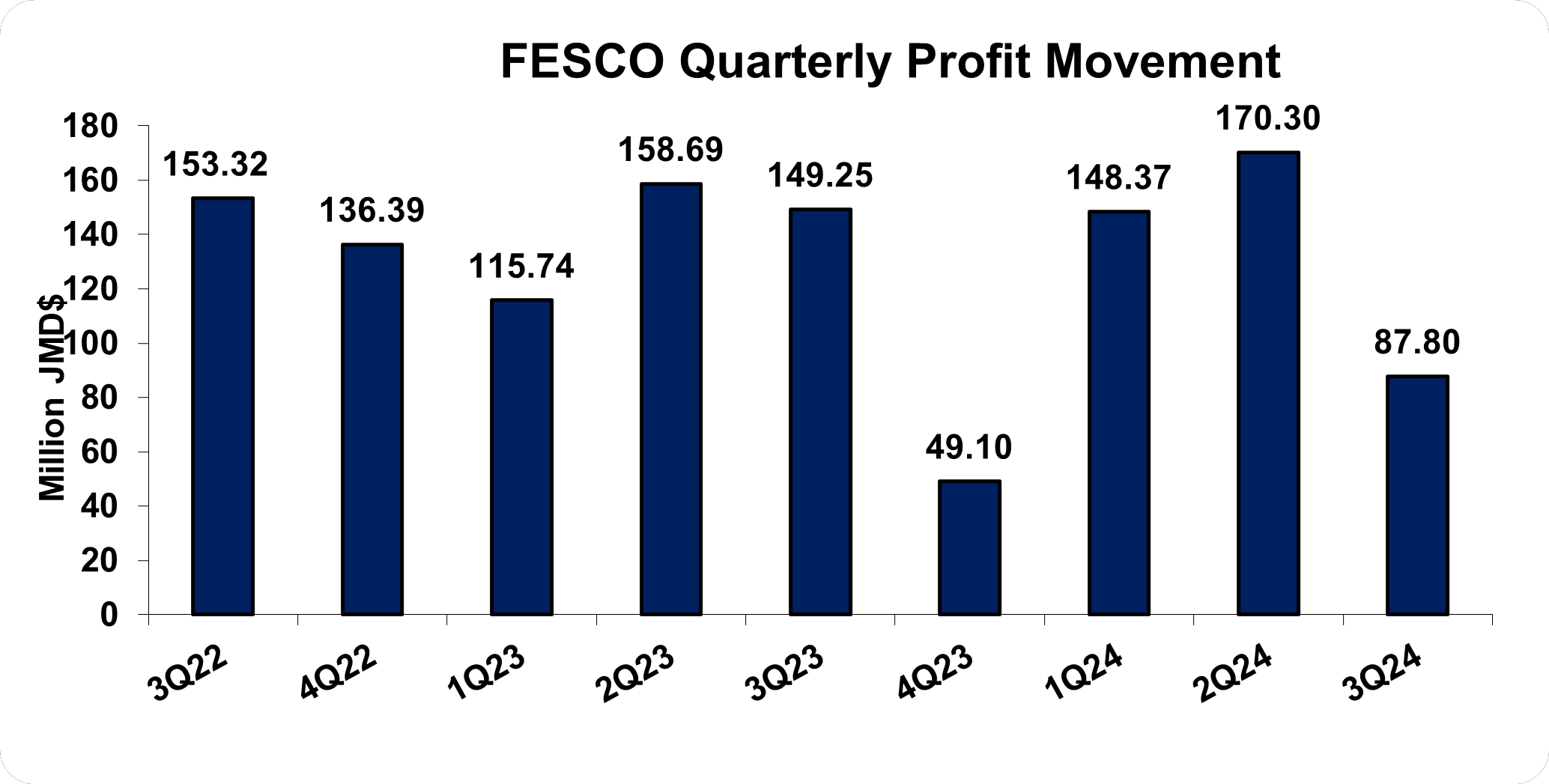

Profit before taxation for the nine months ended December 31, 2024, amounted to $406.47 million, a 24% increase relative to $326.76 million reported in 2023. Profit before taxation for the third quarter amounted to $87.80 million (2023: $109.90 million).

The company did not incur any taxation for the nine months ending December 31, 2024. As such, net profit for the nine months amounted to $406.47 million compared to $326.76 million reported twelve months earlier. For the third quarter, net profit closed at $87.80 million (2023: $109.90 million).

Consequently, Earnings Per Share for the nine months amounted to $0.16 (2023: EPS: $0.13), while Earnings Per Share for the quarter totaled $0.035 (2023: EPS: $0.044). The twelve-month trailing EPS was $0.18, and the number of shares used in these calculations was 2,500,000,000.

Notably, FESCO’s stock price closed the February 14, 2025, trading period at $3.39 with a corresponding P/E ratio of 17.28x.

Balance Sheet Highlights

The company’s assets totaled $5.50 billion (2023: $4.90 billion). The overall growth in the company’s balance sheet is driven by a 31% year-over-year increase in Property, Plant, and Equipment, which reached $3.89 billion up from $2.95 billion in 2023. Right-of-Use assets also contributed to the overall increase in the asset base with a 16% uptick year-over-year totaling $189.46 million relative to $163.10 million in 2023.

Shareholder’s equity was $2.66 billion (2023: $1.77 billion), representing a book value per share of $1.07 (2023: $0.71).