May 9, 2024

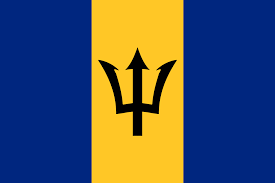

According to the Central Bank of Barbados, despite facing challenges such as elevated foreign interest rates, geopolitical tensions, higher freight costs, and adverse local weather conditions, Barbados’ economy demonstrated growth in early 2024, further strengthening key economic aggregates like the current account balance and debt-to-GDP ratio.

During the first quarter of 2024, real GDP increased by 4.1%, driven by visitor arrivals surpassing the industry’s 2019 peak and broad-based growth across various sectors. This economic expansion contributed to achieving an external current account surplus and further strengthened the financial sector’s resilience. It also helped attain the 2023/24 fiscal year primary surplus target and reduced the debt-to-GDP ratio.

Tourism played a pivotal role in the economic expansion, with record levels of long-stay tourist arrivals, up 14.8% compared to the first quarter of 2023. The construction sector also benefited from private and public projects, including tourism and commercial property development, as well as infrastructure projects. Inflation remained moderate, and labor market conditions improved with a decrease in the unemployment rate.

Barbados’ external position improved, with the current account surplus reaching $25.8 million, driven by higher tourism receipts and increased corporate taxes. Loans from multilateral organizations boosted the financial account, resulting in an accumulation of gross international reserves.

The government achieved its primary balance target for the fifth consecutive fiscal year, despite increased spending on interest payments and grants to public institutions, resulting in a fiscal deficit of $225.9 million. The debt-to-GDP ratio continued its downward trajectory, falling to 114.3%, reflecting sustainable economic growth.

The financial system remained healthy and stable, with declining credit risk and improving loan quality. Both domestic and foreign-currency deposits increased, strengthening the liquid asset ratio. Although banks’ profitability marginally declined due to rising operational expenses, capital adequacy ratios of deposit-taking institutions remained high, ensuring sector stability and resilience.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.