June 30, 2020

MPC Caribbean Clean Energy Limited (MPCCEL), for the year ended December 31, 2019, recorded total income of US$272,407 relative to nil reported for the prior year’s corresponding period. Revenue for the quarter amounted to US$66,549 compared to nil for the same quarter in 2018.

Total expenses amounted to US$212,727 (2018: US$251,848). The company noted, “In 2019 the expenses of the Company exceeded the approved budget by approximately 24,000 USD (+13%). The additional expenses are related to some increased administrative costs attributable to the implementation phase of several services. The budget for the regular course of business of around 188,000 USD, approved for 2019, was found to be an accurate forecast for the related activities in 2020.” The breakdown for total expenses is as followed:

Accountancy fees closed the period at US$11,241 (2018: US$7,705), while MPCCEL reported administrative fees of US$42,676 (2018: US$14,419).

Advertising fees for the year amounted to US$34,985 relative to nil for comparable period in 2018.

Audit fees for the year totalled US$18,000 (2018: US$15,000). The company incurred bank charges for the year of US$3,926 (2018: US$1,076).

Director’s fees and legal & professional fees for the year end totalled US$20,639 (2018: US$6,533) and US$54,726 (2018: US$205,282), respectively.

License fees closed at US$500 (2018: US$500).

Corporate fees amounted to US$1,750 (2018: US$1,333) for the year ended December 2019.

Insurance expense for the year ended December 2019 closed at US$21,663 (2018: nil).

Other expenses amounted to USD$2,508 (2018: nil).

Total expenses for the fourth quarter ended December 31, 2019 amounted to a recovery of US$38,991 relative to total expenses of US$433,515 in the corresponding quarter in 2018.

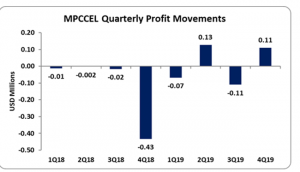

Comprehensive income for the year was reported at US$59,680 relative to a loss of US$251,848. For the quarter, MPCCEL booked a profit of US$105,540 (2018 net loss: US$433,518).

Consequently, earnings per share (EPS) for the year ended December 31, 2019 amounted to US$0.003 relative to a loss per share of US$0.01 for the same period in 2018. For the quarter, MPCCEL booked EPS of US$0.005 (2018 LPS: US$0.02). The number of shares used in this calculation was 21,666,542 units. MPCCEL and MPCCELUS price closed the trading period at a price of JMD$169 and US$1.00 on June 30, 2020, respectively.

MPCCEL stated that, “The underlying assets, Tilawind and Paradise Park of the Company’s investment in the Fund met its operational and financial expectations in 2019. At the end of the year, Tilawind exceeded its forecasted energy production by 2.3%. Paradise Park started commercial operations in June 2019 and reached its target energy production and sales levels after a start-up phase in November 2019. We emphasize, that at the peak of its construction activities, the project employed more than 300 personnel. Over 70 per cent of workers were from Jamaica, mainly from the surrounding communities. Paradise Park was recognized by the Caribbean Renewable Energies Forum (CREF), in September 2019 as the “Best Utility Scale Solar Park” of 2019.”

Balance sheet at a Glance:

As at December 31, 2019, Total Assets for the period closed at US$10 million versus US$182,934. Of this amount cash and cash equivalents amounted to US$89,436 (2018: US$403), while ‘Investment – MPC Caribbean Clean Energy Fund LLC’ amounted to US$9.91 million relative to nil as at December 31, 2018.

Shareholder’s equity totalled US$9.91 million relative to a shareholders’ deficit of US$257,081 in 2018. This resulted in a shareholder’s equity per share of USD$0.46 relative to a shareholder’s deficit of US$0.01 in 2018.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.